19+ Ltv calculator home

Find an office near you. LTV is the reciprocal LTV is based on the.

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Kentucky First First Time Home Buyers Home Buying First Time

For homebuyers who are trying to qualify for an FHA loan an acceptable loan-to-value ratio is 965 if your credit score is at least 580.

. Use this calculator to determine the home equity line of credit amount you may qualify to receive. The formula that a loan to value ratio calculator uses to compute your loans LTV ratio is. This online calculator is ideal for use with both home mortgage purchase and home mortgage refinance plans.

LTV principal amount market value of your property. The formula for LTV is. Enter your estimated home.

Motto Mortgage loan originators are here to help. Besides using an LTV calculator you can also use the formula to calculate LTV. Ad Shopping for the best mortgage rate.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. You only have to enter two. Compare Top Home Equity Loans and Save.

This calculator will estimate how large of a credit line you may be able to qualify for for up to four lender Loan-to-Value ratios percent of value of home a lender is willing to loan out. Loan to Value LTV Calculator. Choose an online LTV calculator to find out the index.

The amount of equity available for a home equity loan or line of credit is determined by the loan-to-value ratio of the home. The resulting number is your loan to value ratio shown as a percentage. Mortgage Loan 320000.

But you need to insert data into the required fields. If your credit score falls between 500. We believe in a simpler smarter way to shop mortgage.

So if the loan amount. If you put 20 down on a 200000 home that 40000 payment would mean the home still has 160000 of debt against it giving it a LTV of 80. This ratio or percentage of the amount of loan that would be forwarded against the appraised value of the property is known as the Loan to Value Ratio or LTV.

Typically a loan-to-value ratio should be 80 or less to avoid having to add PMI. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Bank Has Online Mortgage Calculators To Provide Helpful Customized Information.

Although this formula for. For example the apartment. What is the LTV formula.

Divide the loan price by the home worth. You need to divide 200000 by 250000 to find out what your LTV is. Our Loan-to-Value LTV Ratio Calculator helps you estimate how much you owe on your mortgage compared to your homes current market value.

The remaining 20 must be paid out of your pocket. Down Payment 80000. To calculate your LTV.

Current combined loan balance Current appraised value CLTV. Loan-to-value LTV is the ratio of mortgage to property value expressed as a percentage. You currently have a loan balance of 140000 you can find your loan balance on your monthly loan statement or.

To see how the loan-to-value LTV formula works heres the basic formula and an example. Whether youre wondering if you have enough equity to qualify for the best rates or youre concerned that youre too far upside-down to refinance under the Home. That means your LTV is 80 percent and your deposit is 20.

Ad Our Reviews Trusted by 45000000. LTV Mortgage Amount Appraised property value. For example if youre buying a property worth 250000 and have a deposit of 50000 youll need to get a mortgage.

You can use this Loan to Value Calculator to calculate the loan-to-value LTV and cumulative loan-to-value CLTV ratios for your property. The line of credit is based on a percentage of the value of your home which is also known as. The Loan to Value Ratio LTV shows how much equity you have in a house relative to the amount you want to borrow or already have borrowed and is one of the key risk factors.

Our Loan to Value LTV Calculator is easy to use. This is equal to 08 which is 80 when multiplied by 100. The loan to value LTV ratio is 80 where the bank is providing a mortgage loan of.

Bank Has The Tools For Your Mortgage Questions. For example if youre buying a 100000 property with a 10000 10 deposit youll need a 90.

Mortgage Insurance When Is It Required Mortgage Protection Insurance Mortgage Private Mortgage Insurance

Loan Product Menu Flyer Usda Loan Marketing Flyers Menu Flyer

Lower Burnside Lofts Apartments 60 Se 10th Ave Portland Or Rentcafe

Additionally A Loan With A High Ltv Ratio May Require The Borrower To Purchase Mortgage Insurance To Offset The Financial Institutions Mortgage The Borrowers

Obtaining New Financing After A Short Sale Or Foreclosure For A Kentucky Usda Fha Va And Fannie Mae Loan Mortgage Loan Originator Mortgage Loans Mortgage

Loan To Value Ltv Just One Of The Many Mortgage Terms You Should Know Prior To Starting Your Mortgage And Home Bu Mortgage Mortgage Help Mortgage Payment

Kentucky Manufactured Home Loans For Doublewide Mobile Homes For Fha Va Usda Khc And Fannie Mae Home Loans Manufactured Home Fannie Mae

![]()

Calculator Icon Vintage Food Posters Purple Aesthetic Icon

What Is The Difference Between The Kentucky Freddie Mac Home Possible And The Fannie Mae Home Ready Loan Program Fannie Mae Kentucky Home Loans

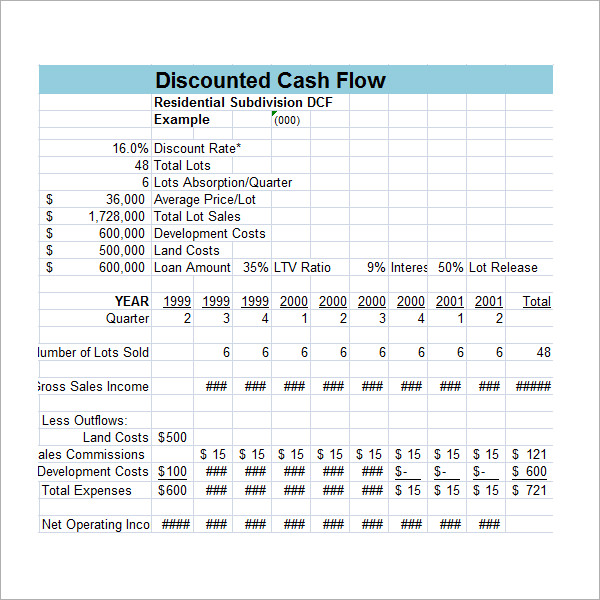

Free 13 Cash Flow Analysis Samples In Pdf Ms Word Excel

Customer Acquisition Cost Calculator Plan Projections Financial Modeling Accounting And Finance How To Plan

We Ve Dropped Our Minimum Fico Score To 620 For Kentucky Mortgage Loan Approvals Mortgage Loans Va Mortgage Loans Mortgage Lenders

Building A Bulletproof Startup Business Model Canvas Vs Lean Startup Vs Disciplined Business Model Canvas Entrepreneurship Books Entrepreneurship

Calculator Iphone App Design Computer Icon Iphone Icon

Rhonda Jenkins Loan Officer In Austin Tx Mortgage Loans Reverse Mortgage Mortgage

Pin By Max Well On Maxwell Mortgage Interest Mortgage Loans Commercial Property

Open Access Loans For Bad Credit Dating Bad Credit